Achieving Corporate Governance that Drives Corporate Value Enhancement

Goals and KPIs

- 2030 Goal

- Implement highly effective corporate governance that enables the Chatwork Group to achieve dramatic growth and long-term corporate value enhancement through exceptional value creation

- 2024 Goal

- Establish corporate governance that is appropriate to stage of growth based on requirements of the Corporate Governance Code

- 2030 KPIs

-

- Ensure the diversity of the Board of Directors (clarify functions to be acquired by the board, disclose skill matrix, etc.)

- Enhance supervisory functions, etc. (at least 50% independent outside directors, increase separation of supervisory and executive functions, establish an internal audit office, evaluate board effectiveness, enhance disclosure of executive compensation)

- Strengthen supervision of response to sustainability issues and information disclosure (establish a Sustainability Committee, disclose ESG information)

Approach and System

Basic Approach to Corporate Governance

We will achieve sustainable growth and long-term corporate value enhancement by continuing to create unique value for society through our mission of "Making work more fun and creative" and our vision of "Empowering everyone to work a step ahead," as well as by meeting the expectations and demands of stakeholders, including shareholders.

Our company was listed on the Tokyo Stock Exchange Mothers Index (at the time) in 2019; however, the environment surrounding our company continues to change. We believe that, in order to achieve sustainable growth in this environment, we must establish highly effective corporate governance. This includes making appropriate and speedy management decisions in response to changes in the business environment, including risk-taking, and managing in a way that is efficient, sound, transparent, and reliable. We will work steadily to further strengthen our governance system going forward in accordance with the Tokyo Stock Exchange's Corporate Governance Code.

We submit Corporate Governance Reports to the Tokyo Stock Exchange.

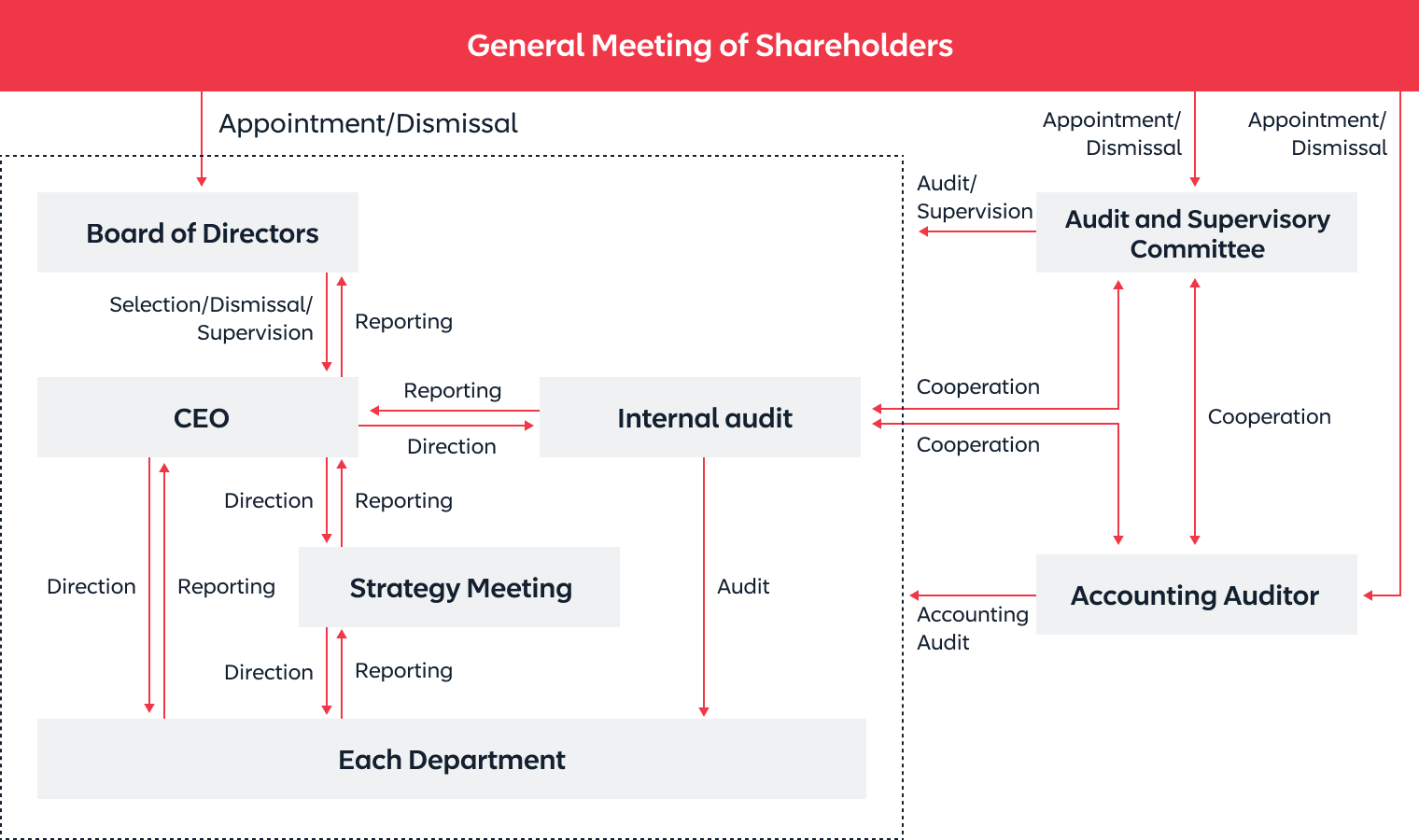

Corporate Governance Structure

We are working to build a corporate governance structure that takes our stage of growth into account based on the belief that establishing a governance structure that can be trusted by shareholders, investors, and other stakeholders is the foundation for sustainable growth and long-term corporate value enhancement. Currently, we are working to further strengthen the audit and supervisory functions of the Board of Directors and further enhance governance. We have chosen to operate as a Company with Audit and Supervisory Committee because we believe that it is effective in improving the fairness, transparency, and efficiency of management by making prompt decisions and executing business through the delegation of authority.

Corporate Governance Structure Chart

Board of Directors

Our Board of Directors takes on the responsibility of enhancing our long-term corporate value by making important management-related decisions, maximizing returns for each stakeholder, and establishing effective corporate governance in order to achieve our corporate mission of "Making work more fun and creative."

In order to fulfill this responsibility, the Board of Directors consists of four directors (including one independent outside director) as of December 2022. However, we are aiming to have at least a majority of independent outside directors in order to maintain a diverse workforce that has a good balance of experience and expertise.

The Board of Directors holds regular monthly meetings in addition to extraordinary meetings as necessary. At these meetings, the Board of Directors makes resolutions on important matters in accordance with Board of Directors regulations as a management decision-making body. The Board of Directors also supervises the execution of business operations and delegates authority as necessary in accordance with internal regulations to speed up the decision-making process regarding the execution of business operations.

Strategy Meeting

The Strategy Meeting consists of directors and executive officers. It meets once a week in principle to deliberate and decide on matters designated by internal regulations such as "Regulations on Administrative Authority." Members of the Strategy Meeting report and share information on the execution of business operations, and deliberate and discuss common issues and other matters.

Investment Committee

The Investment Committee consists of full-time directors. It receives instructions from the Board of Directors and CEO and deliberates on the appropriateness and other aspects of investments. The committee meets at least once per quarter to make decisions on investments and continuously monitor the status of investments that have been made.

Audit and Supervisory Committee

At the 19th Ordinary General Meeting of Shareholders held on March 29, 2023, the Company transitioned to a Company with Audit and Supervisory Committee. The Audit and Supervisory Committee consists of three outside directors who have been Audit and Supervisory Committee members as of March 2023. Audit and Supervisory Committee members hold monthly meetings of the Audit and Supervisory Committee to exchange information, discuss, and make resolutions on important matters related to audits. In addition, Audit and Supervisory Committee members attend meetings of the Board of Directors as outside directors and have a system that allows them to monitor director's execution of duties.

Executive Officer System

We implemented an Executive Officer System to speed up decision-making and enhance our ability to respond to changes in the business environment. This system allows us to execute strategies promptly and reliably by clarifying the authority and responsibilities related to the execution of these strategies and assigning them to executive officers.

Accounting Auditor

We have entered into an auditing contract with Deloitte Touche Tohmatsu LLC.

Meetings Held

| Meeting Body | Name | Unit | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Number of Board of Directors Meetings Attended (Attendance Rate) | |||||

| CEO Masaki Yamamoto | Meetings (%) | 16 (100%) | 16 (100%) | 15 (100%) | |

| CFO Naoki Inoue | Meetings (%) | 16 (100%) | 16 (100%) | 15 (100%) | |

| COO Shoji Fukuda | Meetings (%) | - | - | 12 (80%) | |

| Outside Director Tomohiro Miyasaka | Meetings (%) | - | 13 (81.2%) | 15 (100%) | |

| Outside Full-Time Auditor Takeshi Sugai | Meetings (%) | 16 (100%) | 16 (100%) | 15 (100%) | |

| Outside Part- Time Auditor Hiroyuki Yamada | Meetings (%) | 16 (100%) | 16 (100%) | 15 (100%) | |

| Outside Part- Time Auditor Masayuki Murata | Meetings (%) | 16 (100%) | 13 (81.2%) | 13 (86%) | |

| Number of Investment Committee Meetings Attended (Attendance Rate) | |||||

| CEO Masaki Yamamoto | Meetings (%) | - | - | 4 (100%) | |

| CFO Naoki Inoue | Meetings (%) | - | - | 4 (100%) | |

| COO Shoji Fukuda | Meetings (%) | - | - | 4 (100%) |

Key Areas of Profesional Experience of Directors and Auditors (Skills Matrix)

| Name | Corporate / Business Management | Finance / Accounting | Capital Markets / M&A | Legal / Risk Management | Global Business | Technology / Trends | Business Strategy / Marketing | ESG |

|---|---|---|---|---|---|---|---|---|

| CEO Masaki Yamamoto | ● | ● | ● | ● | ||||

| CFO Naoki Inoue | ● | ● | ● | ● | ||||

| COO Shoji Fukuda | ● | ● | ● | ● | ||||

| Outside Director Tomohiro Miyasaka | ● | ● | ● | ● | ||||

| Outside Director/Audit Committee Member Masayuki Murata | ● | ● | ● | ● | ||||

| Outside Director/Audit Committee Member Akenobu Hayakawa | ● | ● | ● | ● | ||||

| Outside Director/Audit Committee Member Fumiyuki Fukushima | ● | ● | ● | ● |

Chatwork's Main Initiatives

Internal Controls

We have established a "Basic Policy on Internal Control Systems" in order to ensure sound and efficient management of our corporate activities. We maintain and operate an internal control system based on this policy to manage whether there are any problems in areas such as compliance with laws and regulations, reliability of financial reporting, appropriateness of business execution, and corporate risk management.

Policy on Internal Controls

1. System to Ensure that Execution of Duties by Directors and Employees Complies with Laws, Regulations, and Articles of Incorporation

- The Company shall establish a corporate philosophy and internal regulations for the purpose of compliance with laws, regulations, the Articles of Incorporation, and social norms, and disseminate the contents of such regulations to executives and employees.

- In accordance with the "Audit and Supervisory Committee Regulations," the Audit and Supervisory Committee shall audit the directors' execution of their duties from an independent perspective; if they discover any issues regarding legality, they shall point out such fact and recommend to the directors and the Board of Directors to make improvements, and if necessary, request that such action be stopped.

- In accordance with the "Internal Audit Regulations," the person in charge of internal audits shall investigate the true status of business operations and property management, confirm that the execution of duties by employees is in compliance with laws, regulations, the Articles of Incorporation, and internal regulations, and report to the CEO and the Audit and Supervisory Committee.

2. System for Storage and Management of Information Related to Directors' Execution of Duties

- The Company shall appropriately store and manage important information, decision-making items, etc. related to the directors' execution of their duties in accordance with laws, regulations, and internal regulations.

- Directors shall have access to such stored information as necessary.

3. Regulations and Other Systems for Managing Risk of Loss

- In order to properly identify corporate risks, the Company shall identify risk items to be managed at Board of Directors or other meetings, and continuously check their status.

- In the event that a risk materializes, the Company shall establish an emergency response system headed by the CEO, and strive to recover from the risk as quickly as possible.

4. System to Ensure Directors' Efficient Execution of Duties

- The Company shall strive to ensure the efficient execution of duties by holding a regular meeting of the Board of Directors once a month where statutory matters are resolved, important management matters are decided, and business execution is supervised in a flexible manner. In addition, extraordinary meetings of the Board of Directors shall be held as necessary.

- The Company shall ensure prompt and efficient decision-making by establishing the division of duties of each organization and the authority of each position in its regulations, and by delegating authority to the director in charge and the head of each organization in accordance with said regulations.

5. Matters Concerning Employees Assisting the Audit and Supervisory Committee in the Execution of Their Duties When Such Assistance is Requested, Matters Concerning the Independence of Such Employees from Directors Other than Members of the Audit and Supervisory Committee, and Matters Concerning the Effectiveness of Instructions Given to Such Employees

- In the event that the Audit and Supervisory Committee requests that employees be assigned to assist them in their duties, the Company shall, upon consultation with the Audit and Supervisory Committee, assign employees to assist them.

- Instructions from the Audit and Supervisory Committee to such assistant employees shall not be directed or ordered by directors or the head of the department to which the assistant employee belongs, other than those who are members of the Audit and Supervisory Committee.

- The Company shall obtain the consent of the Audit and Supervisory Committee with respect to the transfer, evaluation, and disciplinary action of such assistant employees.

6. Systems for Reporting to the Audit and Supervisory Committee by Directors and Employees, Systems to Ensure that Persons Reporting Will Not be Treated Disadvantageously Because of Such Reports, and Other Systems Related to Reporting to the Audit and Supervisory Committee

- Directors and employees shall immediately report to the Audit and Supervisory Committee the occurrence or potential occurrence of any fact that may cause significant damage to the Company, or any fact that may violate laws, regulations, or the Articles of Incorporation.

- The Audit and Supervisory Committee shall attend meetings of the Board of Directors and other important meetings in order to understand important decision-making processes and the status of business execution. In addition, as part of their auditing duties, they may inspect the minutes of the Board of Directors meetings and important documents such as approval documents and request explanations from directors and employees as necessary.

- The CEO and other managers shall not treat directors and employees who report to the Audit and Supervisory Committee in a disadvantageous manner by reason of the fact that such reports have been made.

7. Matters Concerning Procedures for Prepaid Expenses or Reimbursement of Expenses and Policies Concerning the Handling of Other Expenses or Liabilities incurred in the Execution of Duties by the Audit and Supervisory Committee

- The Company shall bear the actual expenses necessary for the execution of duties by the Audit and Supervisory Committee.

8. Other Systems to Ensure the Effective Implementation of Audits by the Audit and Supervisory Committee

- Directors shall create an environment in which the Audit and Supervisory Committee can attend important meetings of the Board of Directors and other important meetings in order to understand important decision-making processes and the status of business execution, and also create an environment in which auditors can collaborate with external experts, including internal auditors and accounting auditors, as necessary.

- The Audit and Supervisory Committee shall meet regularly with accounting auditors and persons in charge of internal audits to share the audit status of each auditor and strive to conduct effective and efficient audits.

9. Basic Policy on Preventing Transactions with Anti-Social Forces and its Status

- The Company shall stipulate in its internal regulations that it takes a firm stand against anti-social forces and rejects any relationship with anti-social forces, and shall ensure that all directors and employees are fully aware of these regulations.

- The Company shall establish a system to resolve unjust demands, organized violence, and criminal acts by anti-social forces in cooperation with outside professional organizations such as corporate attorneys and the police.

Remuneration System

Remuneration for Directors

Remuneration for directors consists of fixed and variable remuneration (short-term performance-linked compensation and medium- to long-term stock compensation). Short-term performance-linked compensation is linked to rate of achievement against the planned annual budget, and medium- to long-term stock compensation is linked to shareholder value over the medium to long term. We do not set short-term performance-linked remuneration for directors who are Audit and Supervisory Committee members from the perspective of their role and independence.

Maximum Total Amount of Remuneration for Directors (Fiscal Year 2023)

| Director Remuneration (Excluding Audit and Supervisory Committee members) |

Monetary remuneration | Up to 200 million yen per year (including 50 million yen per year for outside directors) |

|---|---|---|

| Stock remuneration | Up to 120 million yen per year (including 20 million per year for outside directors) |

|

| Auditor Remuneration (Audit and Supervisory Committee members) |

Monetary remuneration | Up to 50 million yen per year |

| Stock remuneration | Up to 20 million yen per year |

Total Amount of Remuneration, etc. for Directors and Auditors (FY2022)

| Role | Total Amount of Remuneration, etc. | Total Amount of Remuneration, etc. | Number of Eligible Board Members (People) | |

|---|---|---|---|---|

| Basic Remuneration | Restricted Stock Remuneration | |||

| Board of Directors (Outside Directors) |

117.057 million yen (5.999 million yen) |

60.338 million yen (3 million yen) |

56.718 million yen (2.999 million yen) |

5 (1) |

| Auditors (Outside Auditors) |

14.4 million yen (14.4 million yen) |

14.4 million yen (14.4 million yen) |

- | 3 (3) |

| Total (Outside Directors and Auditors) |

131.457 million yen (20.399 million yen) |

74.738 million yen (17.4 million yen) |

56.718 million yen (2.999 million yen) |

8 (4) |

Major Board of Directors Discussions in Fiscal Year 2022

The Board of Directors discussed the following topics in light of our business situation and various external conditions based on the stock market and social environment in order to achieve our Medium-Term Business Plan.

Major Board of Directors Discussions (Fiscal Year 2022)

- Matters related to Medium-Term Business Plan and enterprise plan

- Matters related to investment policy, including capital investment and M&A

- Matters related to compliance and internal controls

- Matters related to ESG (key issues)

etc.

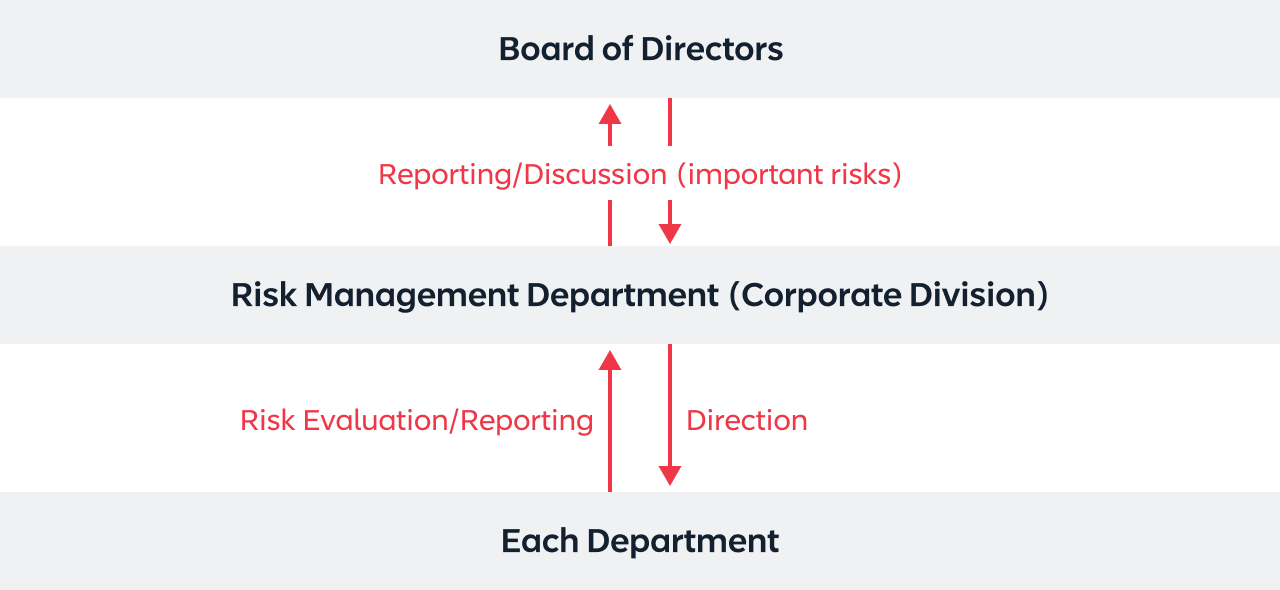

Basic Approach to Risk Management

We have established and are implementing risk management regulations in order to comprehensively recognize and evaluate risks associated with the execution of our business operations and to appropriately respond to such risks. If a risk of loss is discovered due to changes in the internal or external management environment, violations of laws and regulations, violations of the Articles of Incorporation, or other reasons, the Risk Management Department plays a central role in discussing matters such as risk-related measures and responses to incidents, and clarifies a system for reporting the progress and results of said response to the management team.

Risk Management System and Management System

We regularly conduct risk assessments of all departments once a year for the following risk items, report to the Board of Directors, and hold discussions with the CEO and other executives in charge to confirm specific measures and countermeasures. In addition, discussions are held on a case-by-case basis for important risks (incident occurrences, etc.) that require emergency responses to prevent the risks from escalating and to quickly bring them under control.

Risk Items

- Service/system failure risks, business incidences

- Information leakage, false information distribution risks

- Legal/compliance violation, employee misconduct risks

- Abuse/reputation risks

- Safety management/human resource management/asset loss risks

- Business strategy/business management/accounting and finance risks

Risk Management System Chart

Related Key Issues

-

Ensuring Reliable Quality as Business Infrastructure

-

Advanced Information Security and Privacy Protection

-

Conducting Sustainability Management to Achieve Corporate Philosophy

-

Conducting Business Activities with Integrity for All Stakeholders

-

Becoming a Trustworthy Brand and Enhancing Engagement

-

Diversity Management to Achieve New Value Creation